HABIC welcomes today’s announcement…

HABIC welcomes today’s announcement calling for the closure of “Hairdressers” and “Similar Outlets”. In the interest of public health and safety, and to help curb the spread of COVID-19 via community transfer, this was an essential and vital step in protecting our society.

HABIC along with our colleagues, wrote to the Taoiseach seeking clarification around salon closures and requested an economic recovery package that supports domestic SME’s within the hair, beauty and spa industry. Our letter to Taoiseach Leo Varadkar TD can be viewed HERE.

The Pandemic which is COVID-19, is not only a global health crisis, it is an unprecedented Economic Crisis and has and will continue to have significant impact on the Hair, Beauty and Spa industry. Therefore, we ask you now to Stand with Us and Support US by taking the time to sign an online petition seeking Government supports.

Please Sign the Petition HERE

Our Newsletter Today includes the following content:

- Closure of all Non Essential Businesses

- List of Essential Businesses that can remain open

- Insurance – unoccupancy clause

- COVID-19 Income Support Scheme

- Changes to Pandemic Unemployment Support payment

(including details around temporary wage support, changes to

the COVID-19 Pandemic Unemployed benefit and COVID-19

Illness benefit) - BLOG UPDATE (25th Mar) – Temporary COVID-19 Wage Subsidy Scheme

All Non Essential Businesses to Close

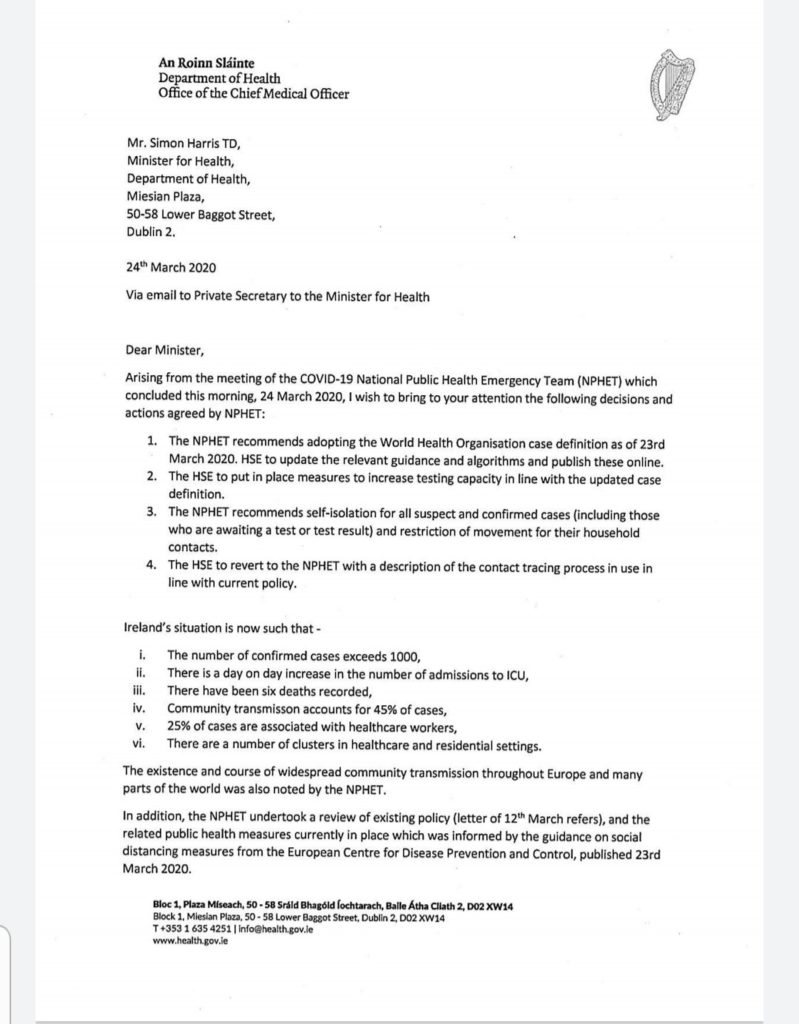

Today (24/03/2020, Minister for Health, Simon Harris TD announced that the National Public Health Emergency Team made a recommendation to close “Hairdressers” and “Similar Outlets”, full details of this recommendation can be viewed in the letter below.

An Taoiseach Leo Varadkar’s full speech with all of today’s announcements can be viewed HERE.

Essential Businesses that can remain open

A list of essential Business that can remain open can be found HERE. They include;

- retail and wholesale sale of food, beverages and newspapers in non-specialised and specialised stores

- retail sale of household consumer products necessary to maintain the safety and sanitation of residences and businesses

- pharmacies/chemists and retailers providing pharmaceuticals, pharmaceutical or dispensing services

- opticians/optometrists

- retail sale of medical and orthopaedic goods in specialised stores

- fuel stations and heating fuel providers

- retailers involved in the repair of motor vehicles, motorcycles and bicycle repair and related facilities (for example, tyre sales and repairs)

- retail sale of essential items for the health and welfare of animals, including animal feed and medicines, animal food, pet food and animal supplies including bedding

- laundries and drycleaners

- banks, post offices and credit unions

- retail sale of safety supply stores (for example, work clothes, Personal Protective Equipment)

- hardware stores, builders’ merchants and stores that provide hardware products necessary for home and business maintenance, sanitation and farm equipment, supplies and tools essential for gardening/farming/agriculture

- retail sale of office products and services for individuals working from home and for businesses

- retailers providing electrical, IT and phone sales, repair and maintenance services for home

All of these outlets that may remain open, must implement social distancing measures. These measures include:

- Ensure adequate distancing between customers and retail assistants in line with public health guidelines

- Only let people into the store in small groups and ensure spaces are not crowded

- Manage queues inside and outside the door to maintain necessary social distancing

- All retail outlets are encouraged to designate certain times of the day to facilitate vulnerable groups who may need to use their services

- Where practicable and in so far as is possible, parents are encouraged to limit bringing their children with them when visiting essential retail outlets

- All retailers are encouraged to provide on-line services where that is possible and appropriate to minimise footfall

- All such retailers are encouraged to offer contactless payment arrangements

- All other retailers can continue to operate if they can do so on an on-line basis having regard to general social distancing measures appropriate to all workplaces

Insurance

If you have not done so already, it is essential that you take the time to review your insurance policy. You should note that if your business has closed and the building is unoccupied, your policy may stipulate that you inform your insurance company. Many policies have a 30 day un-occupancy clause, as premises are deemed higher risk when empty. It is VITAL that you check your policy, to review any clauses detailed, and contact your insurance company for clarification.

Government announces new COVID-19 Income Support Scheme (source

GOV.ie)

The government has today announced a National COVID-19 Income Support Scheme which can be viewed HERE

This will provide financial support to Irish workers and companies affected by the crisis. In summary:

- a temporary wage subsidy of 70% of take home pay up to a maximum weekly tax free amount of €410 per week to help affected companies keep paying their employees. This is the equivalent of €500 per week before tax

- workers who have lost their jobs due to the crisis will receive an enhanced emergency COVID-19 Pandemic Unemployment Payment of €350 per week (an increase from €203)

- the COVID-19 illness payment will also be increased to €350 per week

- the self-employed will be eligible for the COVID-19 Pandemic Unemployment Payment of €350 directly from the Department of Employment Affairs and Social Protection (rather than the Revenue scheme)

- enhanced protections for people facing difficulties with their mortgages, rent or utility bills

It follows from a range of supports already in place to help business through the crisis. The government is taking these extraordinary measures to help ordinary Irish citizens and families during this period of great economic and social stress. These measures will be costly – with an initial estimated cost of €3.7 billion over a twelve week period. The government believes these costs are necessary to ensure social solidarity with workers and their families affected by the crisis.

Changes to Pandemic Unemployment Support payment

An eligible employer will be supported up to 70% of an employee’s take home income up to a maximum weekly tax free payment of €410 (that is, 70% of take home weekly income of €38,000 per annum). The scheme will provide support on incomes up to €76,000 or twice average earnings. It will be capped at net €350 for incomes between €38,000 and €76,000.

The employer is expected to make best efforts to maintain as close to 100% of normal income as possible for the subsidised period. Revenue will provide further guidance on operation of the scheme. There will be severe penalties for any abuse of the scheme.

Eligibility for the Income Support Scheme

Employers must self-declare to Revenue that they have experienced significant negative economic disruption due to COVID-19, with a minimum of 25% decline in turnover, and an inability to pay normal wages and other outgoings, in accordance with guidance to be issued by Revenue.

This scheme is open to impacted employers in all sectors. This recognises the impact that COVID-19 is having across all parts of the economy.

The employee must have been on the payroll in February 2020.

Self-employed workers

Self-employed who qualify will be paid the COVID-19 Pandemic Unemployment Payment of €350 rather than through the Revenue scheme. They will be eligible on a similar basis as the Revenue scheme for employees.

How to apply

Revenue and the Department of Employment Affairs and Social Protection will provide details to employers today on how to apply.

Eligibility for COVID-19 Pandemic Unemployment Payment

People who have already been approved for the COVID-19 Pandemic Unemployment Payment will now get an increased payment of €350 per week (instead of €203) at their next payment date. Anyone else who loses their job due to the COVID-19 crisis can apply to the department for payment at the new rate. The COVID-19 illness payment will also be increased to €350 per week. Further details are available from the Department of Employment Affairs and Social Protection.

Duration of the Income Support Scheme

The new Scheme will be in place for twelve weeks.

Cost of the schemes

It is estimated that these new measures will cost approximately €3.7 billion over the 12 week period.

Exchequer affordability

The full economic impact of the COVID-19 crisis is subject to considerable uncertainty but will clearly have a very significant negative impact on the Exchequer. However, these measures are necessary to provide support to workers, their families, and companies at a time of great economic and social stress. The State will be able to fund these measures, but it will generate additional debt which will need to be paid off in the future.

Ireland is well placed to increase its borrowing activity in the coming years. This additional borrowing will take place against a backdrop of a strong improvement in Ireland’s debt position in recent years, which has been reflected in a solid trend of lower borrowing costs, strong demand for Irish sovereign debt among international investors over a protracted period and ratings upgrades by each of the major credit rating agencies.

Our strategy in recent years of prefunding liabilities means we have already built up strong cash balances. At the end of February, we had €26 billion in cash effectively funding this year’s €19 billion of redemptions.

Measures in place for renters

The government is introducing legislation to prevent both the termination of residential tenancies and any rent increases for the duration of the COVID-19 crisis.

The banks have also said they will support buy-to-let bank customers with tenants affected by COVID-19 with an opportunity to seek a payment break of up to 3 months – so they can in turn offer forbearance to their tenants.

Rent Supplement is also available as a short-term income support to those in the private rented sector who are experiencing difficulty paying their rent. In view of the difficulties created for many in the private rented sector who have lost significant employment income, the Department of Employment Affairs and Social Protection will use the full flexibility of the scheme to provide the necessary support.

Measures in place for mortgage holders

A series of measures to support people impacted by COVID-19 have been announced by the banking sector.

These include:

- flexible arrangements, including a payment break for mortgages and other loans. Customers affected by COVID-19 must contact their bank to discuss the flexibility available to them, including the possibility of a payment break of up to 3 months. Non-bank mortgage lenders and credit servicing firms have also announced their support for this measure

- support for buy-to-let bank customers with tenants affected by COVID-19 – customers with rental property in which the tenants are adversely impacted by COVID-19 will also be provided with flexibility including with an opportunity to seek a payment break of up to 3 months, which will allow them to exercise due levels of forbearance to their tenants

- payment breaks as a result of COVID-19 will not affect credit records

Measures in place for people struggling with utility bills

The Commission for Regulation of Utilities (CRU) has issued a moratorium on disconnections of domestic customers for non-payment to the gas and electricity suppliers.

The suppliers have arrangements in place for any domestic/residential customers in arrears which are overseen by CRU and have a number of emergency provisions to assist Pay As You Go customers.

Supports for business

In addition to the Scheme being announced today, the government has already announced a range of measures including:

(i) financial supports, including a €200 million Strategic Banking Corporation of Ireland Working Capital scheme; a €200 million Rescue and Restructuring Scheme available through Enterprise Ireland for vulnerable but viable firms; the maximum loan available from Microfinance Ireland has been increased from €25,000 to €50,000 (these loans are now interest free with no repayments for 6 months); Local Enterprise Offices in every county will be providing vouchers from €2,500 up to €10,000; a Finance in Focus grant of €7,200 will be available to Enterprise Ireland and Údarás na Gaeltachta clients.

(ii) other supports including a First Responder support service through the Intreo Offices and development agencies, Enterprise Ireland and IDA Ireland in each region to provide tailored supports for affected businesses; the Department of Employment Affairs and Social Protection Short Term Work Support Scheme.

(iii) deferral of Business Rates: the government has agreed with local authorities that they should defer rates payments due from the most immediately affected businesses, primarily in the retail, hospitality, leisure and childcare sectors, until the end of May.

(iv) Taxation Measures to alleviate short-term difficulties: Revenue has also posted specific advice for businesses experiencing trading difficulties as a result of COVID-19 including information on tax returns, the application of late payment interest, debt enforcement, tax clearance and customs.

These are the highlights:

- interest on late payments is suspended for January/February VAT and both February and March PAYE (Employers) liabilities

- all debt enforcement activity is suspended until further notice

- current tax clearance status will remain in place for all businesses over the coming months

- the Relevant Contract Tax (RCT) rate review scheduled to take place this month (March) is suspended

- critical pharmaceutical products and medicines will be given a Customs ‘green routing’ to facilitate uninterrupted importation and supply

(v) Banking and Credit Measures: All the banks have announced that they will offer flexibility to their customers, and they may be able to provide payment holidays or emergency working capital facilities.

The main non-bank lenders also confirmed their intention to also support the range of measures announced by the country’s main retail banks which is to be welcomed.

A deferral of up to 3-months on loan repayments will be available to many businesses. In addition, the banks are adopting a customer-focussed approach to these businesses with a wide variety of tailored supports including extensions of credit lines, risk guarantees, and trade finance. These supports complement the range of government supports available through the Strategic Banking Corporation of Ireland.

The Central bank has confirmed that it will allow banks to dip into their rainy-day capital reserves to keep lending flowing. It is anticipated that this move could free up considerable additional credit for households and businesses.

A small but important change for many businesses is the limit for contactless credit card payments has been raised from €30 to €50

Temporary COVID-19 Wage Subsidy Scheme

Full details of the Wage Subsidy Scheme can be found HERE

General Information

The Government announced new measures to provide financial support to Irish workers affected by the Covid-19 crisis. As part of these measures, Revenue will operate a Temporary Wage Subsidy Scheme. The scheme, enables employees, whose employers are affected by the pandemic, to receive significant supports directly from their employer. The scheme expected to last 12 weeks from 26 March 2020. Draft legislation governing the scheme will be published shortly.

The operation of the Temporary Wage Subsidy Scheme will be available to employers who keep employees on the payroll throughout the COVID-19 pandemic, meaning employers can retain links with employees for when business picks up after the crisis. Additionally, the operation of the scheme will reduce the burden on the Department of Employment Affairs and Social Protection (DEASP) which is dealing with the other Covid-19 related payments.

Employers are encouraged to facilitate employees by operating the scheme, by retaining employees on their books and by making best efforts to maintain a significant, or 100% income, for the period of the scheme.

Key Features of the scheme

- Replaces the previous COVID-19 Refund Scheme.

- Initially, and from this Thursday (26 March 2020), the subsidy scheme will refund employers up to a maximum of €410 per each qualifying employee.

- However, employers should pay no more than the normal take home pay of the employee.

- The subsidy scheme applies to employers who top up employees’ wages and those that aren’t in a position to do so.

- Employers make this special support payment to their employees through their normal payroll process.

- Employers will then be reimbursed for amounts paid to employees and notified to Revenue via the payroll process.

- The reimbursement will, in general, be made within two working days after receipt of the payroll submission.

- In April, the scheme will move to a subsidy payment based on 70% of the weekly average take home pay for each employee up to a maximum of €410*.

- Income tax and USC will not be applied to the subsidy payment through the payroll.

- Employee PRSI will not apply to the subsidy or any top up payment by the employer.

- Employers PRSI will not apply to the subsidy will be reduced from 10.5% to 0.5% on the top up payment.

REMINDER !

TOMORROW Wed 25th. Valuable Advice from the Fantastic Hairdresser; Three steps to survive a Coronavirus shutdown (Source; The Fantastic Hairdresser)

This post is well worth taking the time to read, Alan looks at these three points

STEP 1 – RUTHLESS BUDGETING

STEP 2 – FINANCIAL SOLUTIONS

STEP 3 – PREPARE FOR THE FUTURE

Industry Expert Alan Austin Smith offers invaluable advice in his most recent blog post which can be read HERE . To Book Click HERE

How can HABIC support YOU?

If there is additional information or assistance the you require at this time, please post in the comment box below and we will endeavour to address your query. #HABICtogether,

JOIN HABIC TODAY – Receive COVID-19 and Industry Updates direct to your inbox. JOIN NOW

Add vote and comments to text box below

You must be logged in to post a comment.