Are you eligible?

If you are, the closing date for the receipt of Applications for Phase 1 of the Small Business Assistance Scheme is fast approaching. The application deadline is Wednesday 21st April 2021.

What is the SBASC?

SBASC is intended to help businesses with their fixed costs, for example; rent, utility bills, security. It is run on a first-come-first-serviced basis and gives grants to businesses who are not eligible for;

- the Government’s COVID Restrictions Support Scheme (CRSS)

- the Fáilte Ireland Business Continuity grant

- other direct sectoral grant schemes

This scheme will be rolled out in Phases, with Phase 1 (1st quarter of the year) currently open for applications. Phase 1 will see a grand payment of €4,000 available. To qualify for the scheme the enterprise must;

- Employ 250 or less

- Have a turnover of over €50,000

- The turnover of the business over the claim period is estimated to be no more that 25% of previous levels.

Here’s some more details on SBABC;

- the scheme is available to companies, self-employed, sole traders or partnerships;

- minimum turnover of €50,000;

- are not owned and operated by a public body;

- the business is not eligible for CRSS or Fáilte Ireland Business Continuity Scheme or other sectoral grant scheme;

- they are in receipt of a rates bill from their local authority for business which operates from a building, or similar fixed physical structure on which business rates are payable (mobile premises, or premises which are not permanently fixed in place, do not meet the definition of business premises nor do premises on which no rates are payable);

- the turnover of the business over the claim period is estimated to be no more than 25% of the average weekly turnover of the business in 2019 or the projected average weekly turnover of the business for 1 January to 30 June 2021 for businesses that commenced after 1 November 2019;

- the business intends to resume trading in full once Government restrictions are eased. The scheme will aid eligible businesses for the period beginning 1 January to 31 March 2021;

- the grant will be paid via the Local Authorities, based on an online application;

- eligible applications will receive an initial payment of €4,000 for Q1 2021; and

- payments will be dispersed in the same format as rates refunds via bank transfer.

For more COVID-19 business supports visit enterprise.gov.ie/coronavirus.

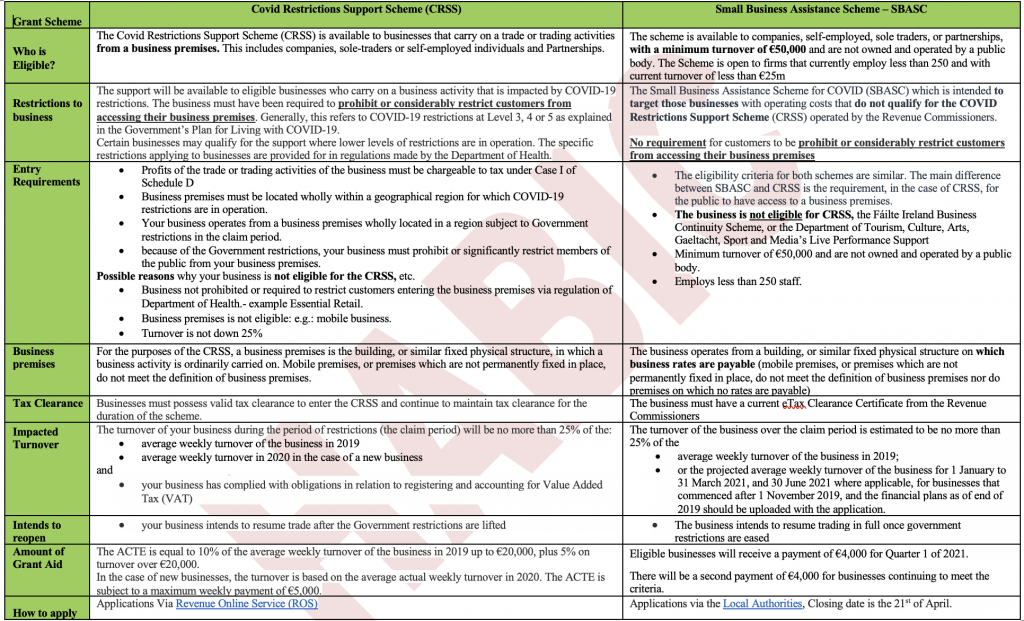

SBASC Vs CRSS

We recently posted about the CRSS – the COVID Restrictions Support Scheme. In this post we set out the terms and qualification for this scheme.

Who can Apply for the CRSS?

Just as the SBASC, Companies, self-employed and partnerships that carry out a taxable trade can apply. For more details see Section 2 of the CRSS Guidelines. Here’s a link to a Revenue webinar that explains all. Click ‘Join the Event’ to view.

To qualify, there is a criteria that you must meet which includes the following:

- your business premises must be closed or substantially restricted due to imposed COVID-19 restrictions.

- You must intend to reopen when said restrictions have been lifted.

- You must self-declare to Revenue that because of the COVID-19 restrictions, turnover for the restricted period is disrupted by 75% compared to 2019 levels.

- You must also have a valid Tax Clearance Cert and meet your VAT obligations.

Please note: When restrictions are lifted and you can reopen but choose not to, you are not eligible for CRSS.

HABIC Explains: SBASC Vs CRSS

If you are confused as to which Scheme is right for your business we have set out the two schemes side by side to assist you. You can also download this comparative information here.

More information:

- https://enterprise.gov.ie/en/What-We-Do/Supports-for-SMEs/COVID-19-supports/SBASC.html

- https://www.gov.ie/en/press-release/16d20-tanaiste-opens-applications-for-phase-1-of-8000-grant-under-new-small-business-assistance-scheme-for-covid-sbasc/

- https://www.localenterprise.ie/Kildare/News/Small-Business-Assistance-Scheme-for-Covid-SBASC-.html

Add vote and comments to text box below

You must be logged in to post a comment.